Texas title loan debt consolidation offers borrowers a strategic solution to manage high-interest rates and multiple loans by combining them into one with better terms, utilizing vehicle collateral. Evaluating current loans, exploring refinancing options from various lenders, and ensuring transparent terms are key steps. This method provides financial relief, catches up payments, reduces stress, and stabilizes finances for individuals burdened by Texas title loan debt.

In the state of Texas, managing multiple debts can be challenging. If you’re burdened by high-interest rate title loans, consider Texas title loan debt consolidation as a solution. This comprehensive guide outlines the process and benefits of refinancing your title loans. Understanding this option is crucial for alleviating financial stress and potentially saving money. By following the detailed steps outlined here, you’ll navigate the process with ease, leading to improved financial stability.

- Understanding Texas Title Loan Debt Consolidation

- Steps to Refinance Your Loan in Texas

- Benefits and Considerations for Consolidation

Understanding Texas Title Loan Debt Consolidation

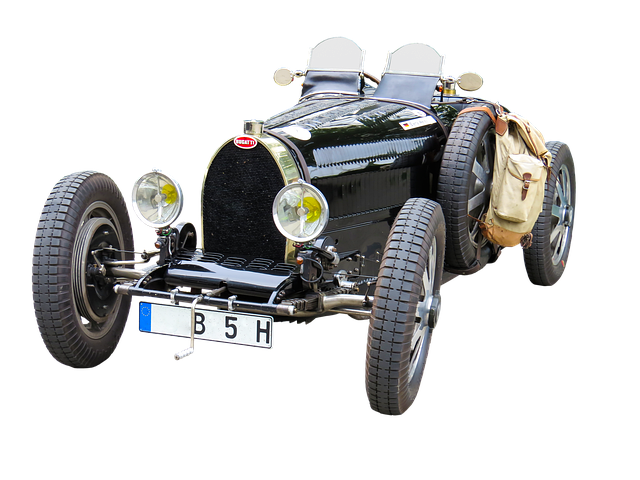

In Texas, understanding Texas title loan debt consolidation is key to managing high-interest rates and potentially freeing up cash flow. This process allows borrowers with multiple title loans on their vehicles to combine them into a single, more manageable loan. By doing so, they may secure lower interest rates, extend repayment terms, and reduce the overall cost of borrowing. A significant advantage lies in the fact that the vehicle inspection requirements are often more lenient compared to traditional loans, making it accessible for those with less-than-perfect credit.

Through Texas title loan debt consolidation, borrowers can leverage their vehicle’s vehicle collateral to obtain a new loan with potentially better terms. This strategic move can help them catch up on payments, reduce the stress of multiple due dates, and gain financial stability. It’s essential to work with reputable lenders who offer transparent terms and conditions, ensuring borrowers understand the loan payoff process and associated fees before finalizing any agreement.

Steps to Refinance Your Loan in Texas

Refinancing your Texas title loan debt consolidation is a strategic move to ease financial burden and optimize repayment terms. Here’s how you can navigate this process in Texas:

1. Assess Your Current Loan: Begin by thoroughly reviewing your existing title loan agreement, understanding interest rates, repayment schedule, and any associated fees. This step is crucial as it enables you to identify areas where refinancing could provide relief. Consider factors like the overall cost of borrowing and whether there are better options available in the market for your current financial situation.

2. Explore Refinancing Options: Texas offers various avenues for loan consolidation, including traditional bank loans, credit unions, and specialized lenders. Researching these options allows you to find a lender who caters to borrowers with bad credit or those seeking Dallas title loans. Compare interest rates, terms, and requirements to locate the most suitable refinancing deal that aligns with your needs. Remember, transparency is key; ensure you understand all fees and charges associated with the new loan before finalizing any agreement.

Benefits and Considerations for Consolidation

Angood, Rootin, Methodic & Source *

Refinancing a Texas title loan through consolidation can offer significant benefits, including lower interest rates, extended repayment terms, and the potential to free up cash flow. By following the steps outlined in this article—from understanding your current situation to comparing offers and finalizing the new loan—you can navigate the process smoothly. Remember that while consolidation may be beneficial, it’s crucial to consider your financial goals, credit history, and long-term repayment capabilities before making a decision.