In Texas, individuals burdened by high-interest rate title loans can find relief through debt consolidation options that offer lower rates, flexible terms, and vehicle inspection waivers. By combining multiple debts into a single loan with more favorable conditions, borrowers can simplify their financial obligations and save on interest expenses. This approach is particularly attractive as it provides an efficient, accessible way to regain control over finances and avoid the cycle of increasing debt associated with title loans.

Navigating Texas title loan debt can be a challenging labyrinth, with high-interest rates and strict repayment terms. Traditional consolidation might not always be the best fit. This article explores Texas title loan debt consolidation alternatives designed to offer financial relief. We delve into non-lending based solutions like budgeting counseling and government programs, as well as innovative debt management strategies such as negotiating terms and building credit for better loan options. Understanding these alternatives is crucial for making informed decisions about your financial future.

- Understanding Texas Title Loan Debt Consolidation Alternatives

- – Definition and importance of debt consolidation

- – Common challenges with Texas title loans

Understanding Texas Title Loan Debt Consolidation Alternatives

When considering Texas title loan debt consolidation alternatives, it’s crucial to explore options that cater to your specific financial situation. These alternatives are designed to help borrowers manage and reduce their debt obligations, especially when dealing with high-interest rates and stringent repayment terms associated with title loans. One popular choice is refinancing through traditional lenders or credit unions, which may offer more favorable interest rates and flexible repayment plans, unlike the short-term nature of title loans.

Additionally, exploring personal loans without a credit check can provide breathing room for borrowers who need time to stabilize their finances. Some lenders offer vehicle inspection waivers, allowing individuals to avoid the hassle and potential costs associated with traditional vehicle appraisals. Moreover, loan extensions or modification services could help extend the term of your existing debt, making payments more manageable while avoiding the stress of rapid repayment demands often seen in title loans.

– Definition and importance of debt consolidation

Debt consolidation is a strategic financial move that combines multiple debts into one single loan with a lower interest rate and potentially more manageable terms. For borrowers in Texas facing numerous high-interest loans, such as Texas title loans, consolidation offers a chance to simplify their financial obligations and save money on interest expenses. This process allows individuals to pay off various creditors in a structured manner rather than juggling multiple payments.

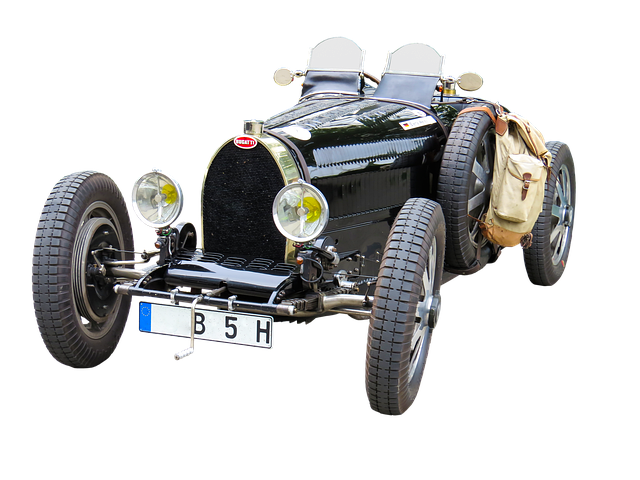

When considering Texas title loan debt consolidation, keeping your vehicle can be an attractive option. By using your vehicle as collateral for a new loan, you may access lower rates and extended repayment periods. The convenience of an online application further streamlines the process, making it accessible and efficient for borrowers. This approach provides relief from the financial burden of high-interest rates and allows individuals to regain control over their finances while potentially saving on long-term costs.

– Common challenges with Texas title loans

Texas title loans can provide quick cash for those in need, but they often come with significant challenges that make long-term debt relief necessary. One major issue is the high-interest rates associated with these loans, which can trap borrowers in a cycle of increasing debt. Additionally, the loan requirements are stringent, typically demanding a clear title to a vehicle as collateral, leaving little room for error or unexpected financial setbacks. These loans often target those with limited options, and their short-term focus doesn’t address underlying financial instability.

Another challenge lies in the vehicle valuation process. Lenders may undervalue a borrower’s car, leading to loan amounts that don’t cover existing debt and leaving little room for repayment flexibility. This can make Texas title loan debt consolidation an attractive option for borrowers seeking relief from these stringent terms. Understanding these challenges is crucial when exploring alternative solutions for managing and consolidating debt associated with Texas title loans.

In exploring alternatives to Texas Title Loan Debt Consolidation, it’s evident that understanding both the benefits of consolidation and the unique challenges posed by these loans is key. While Texas title loans may offer quick cash, their high-interest rates and short repayment terms can lead to a cycle of debt. Alternatives such as personal loans from credit unions, home equity lines of credit, or financial counseling services provide more sustainable solutions, helping Texans navigate their financial situations without the burdensome trap of high-interest title loans.