Texans seeking to consolidate high-interest title loans should understand state regulations and compare lender terms. Organize documentation, including IDs and proof of income, along with records of existing loans, for a swift application process. This strategic approach enables residents to use vehicle equity for lower-interest consolidation loans, simplifying repayment and potentially freeing up extra cash through Texas title loan debt consolidation.

In Texas, understanding the process of Texas title loan debt consolidation is crucial for managing high-interest rates and extending repayment terms. This article serves as your guide through the essential steps and documents required for a successful consolidation application. By delving into the state’s specific regulations, we’ll outline the necessary paperwork, including identification, financial statements, and loan details. Mastering these requirements is the first step towards debt relief in Texas.

- Understanding Texas Title Loan Requirements

- Necessary Documents for Consolidation Application

- The Process of Debt Relief in Texas

Understanding Texas Title Loan Requirements

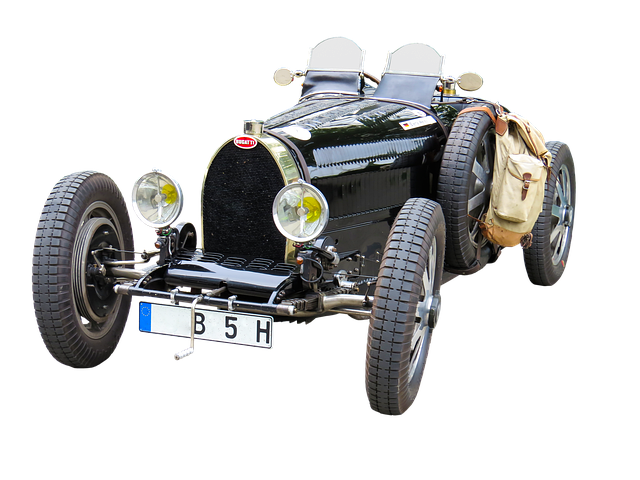

When considering Texas title loan debt consolidation, understanding the state’s specific requirements is essential for a smooth application process. In Texas, lenders must adhere to strict regulations regarding title loans, which are short-term financial solutions secured by a vehicle’s equity. These rules aim to protect borrowers and ensure fair lending practices. For instance, lenders must provide clear and transparent information about interest rates, loan terms, and the potential consequences of defaulting on the loan.

Houston Title Loans, as an example, operates within these guidelines, offering competitive interest rates and flexible repayment plans for eligible Texas residents. The process begins with assessing the vehicle’s equity to determine the maximum loan amount. It’s crucial to compare different lenders’ terms and conditions, especially regarding interest rates, to find the best option suitable for your financial situation. This approach ensures that you make an informed decision while consolidating your title loan debt in Texas.

Necessary Documents for Consolidation Application

When considering Texas title loan debt consolidation, having the right documents is key to a smooth application process. The necessary paperwork varies slightly depending on the lender but generally includes identification documents like a valid driver’s license or state ID. It’s also crucial to provide proof of income, such as pay stubs or tax returns, to demonstrate your ability to repay the consolidated loan.

Additionally, you’ll need documentation related to your existing title loans, including details about the loan amount, interest rates, and repayment terms. A clear understanding of these aspects allows lenders to assess the feasibility of consolidation and offer tailored financial assistance. For instance, a Title Transfer might be required to consolidate multiple loans into one, streamlining your debt management efforts with potential same-day funding options.

The Process of Debt Relief in Texas

In Texas, debt relief is a process that offers individuals a way to regain control over their finances by consolidating high-interest debts into a single loan secured by their vehicle. This particularly benefits those who have taken out San Antonio loans or explored options for semi truck loans, often leading to substantial savings on interest rates. The state’s favorable laws facilitate this process, allowing borrowers to use the equity in their vehicles to obtain a lower-interest consolidation loan, thereby reducing monthly payments and overall debt burden.

This approach is especially appealing for Texas residents facing overwhelming debt from multiple sources, as it provides a strategic financial solution. By consolidating debts, borrowers can simplify their repayment schedule, make smaller monthly installments, and potentially free up extra cash to handle other financial obligations or save for the future. The process involves several steps, including loan application, vehicle appraisal, and documentation verification, all aimed at ensuring a secure and beneficial debt-relief strategy.

When considering Texas title loan debt consolidation, having a clear understanding of required documents is essential. This article has outlined the necessary papers needed for a successful application and walked through the debt relief process specific to Texas. By gathering these key documents, individuals can navigate the path to financial freedom and consolidate their title loan debts effectively.