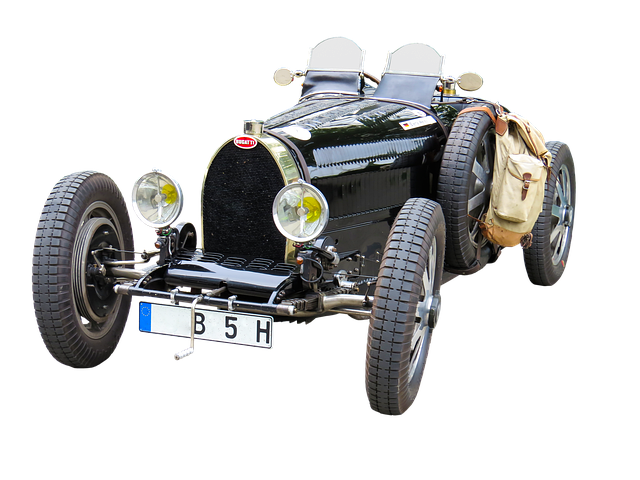

Texas title loan debt consolidation transforms multiple high-interest loans into one manageable loan, simplifying repayment and freeing up cash flow. Borrowers assess their current loans, identify eligible collateral like vehicles through Truck Title Loans, and initiate a title transfer with the lender. Flexible terms aligned to financial capabilities can lead to better borrowing power and future refinancing opportunities. This strategic approach offers long-term financial flexibility by reducing interest rates and enhancing budget management.

After consolidating your Texas title loans, a new financial reality unfolds. This process, involving the refinancing of multiple high-interest loans into one manageable payment, offers relief from the burden of numerous due dates and soaring rates. You’ll experience lower monthly payments and extended terms, allowing for better budget management. However, understanding the long-term implications is crucial. This article provides a comprehensive guide to navigating the aftermath, highlighting benefits like improved cash flow and debt reduction while also considering potential challenges.

- Understanding Texas Title Loan Debt Consolidation: A Comprehensive Overview

- The Process of Consolidating Texas Title Loans: Step-by-Step Guide

- Benefits and Considerations After Debt Consolidation for Texas Title Loans

Understanding Texas Title Loan Debt Consolidation: A Comprehensive Overview

When considering Texas title loan debt consolidation, it’s crucial to understand the process and its benefits. This comprehensive approach allows borrowers to combine multiple high-interest title loans into a single, more manageable loan with potentially lower interest rates. By consolidating, individuals can simplify their repayment schedule, making it easier to stay current on payments and avoid default.

Texas title loan debt consolidation offers various repayment options tailored to individual needs. Borrowers can choose terms that align with their financial capabilities, whether opting for a shorter duration with higher monthly payments or extending the term for lower monthly outlay. Additionally, consolidating loans can lead to better borrowing power and the potential for refinancing opportunities in the future, providing long-term financial flexibility.

The Process of Consolidating Texas Title Loans: Step-by-Step Guide

Consolidating Texas title loan debt can be a strategic move to simplify and manage your repayments effectively. The process involves several steps that ensure a smooth transition and potentially better financial terms. Firstly, borrowers need to evaluate their current loans and identify the title collateral involved, which could include various types of vehicles like cars or trucks (Truck Title Loans). This assessment is crucial as it determines the eligible assets for consolidation.

Once identified, the next step is to initiate a title transfer process. This involves contacting the original lender to discuss consolidation options and gathering necessary documentation. After agreeing on terms, a new loan with consolidated repayment terms will be structured, replacing the multiple outstanding loans. Borrowers can then choose from various Repayment Options offered by the consolidator, tailored to their financial capacity and preferences, ensuring they take control of their Texas title loan debt effectively.

Benefits and Considerations After Debt Consolidation for Texas Title Loans

After consolidating your Texas title loan debt, there are several key benefits to consider. One of the primary advantages is improved financial management and clarity. By combining multiple high-interest loans into a single repayment schedule with potentially lower interest rates, you can simplify your finances and make managing your debt less overwhelming. This can free up cash flow, allowing you to budget more effectively for other essential expenses or even savings goals.

Additionally, Texas title loan debt consolidation offers the potential for long-term financial stability. By reducing the overall interest paid over time, you could save significant money compared to maintaining separate loans with varying rates and terms. This can be especially beneficial if your original loans had high-interest rates or inflexible repayment conditions. Remember, understanding your Loan Requirements and choosing a reputable lender that offers transparent Interest Rates during consolidation is crucial for achieving these advantages.

After consolidating your Texas title loans, you gain financial clarity and relief. This process allows you to manage your debt more effectively by reducing interest rates and simplifying repayment terms. While it offers numerous benefits, it’s crucial to remember that consolidation is just one step towards financial health. Continuing to make timely payments and practicing responsible borrowing will ensure a successful financial future in Texas.