Texas title loan debt consolidation offers relief for residents burdened by multiple high-interest car title loans. By combining these loans into one repayment plan, borrowers can reduce interest costs and gain flexibility. However, careful consideration of associated fees beyond interest rates is crucial to making informed decisions, as hidden expenses may impact overall costs.

In Texas, title loan debt consolidation offers a potential solution for borrowers facing multiple high-interest payments. This article delves into the intricacies of this process, focusing on understanding the unique challenges of Texas title loan debt and exploring the benefits consolidation can bring. We also uncover the fees associated with consolidating these loans, providing a transparent overview to help Texans make informed decisions about their financial future.

- Understanding Title Loan Debt in Texas

- Benefits of Consolidation for Texas Borrowers

- Exploring Fees Associated with Consolidation

Understanding Title Loan Debt in Texas

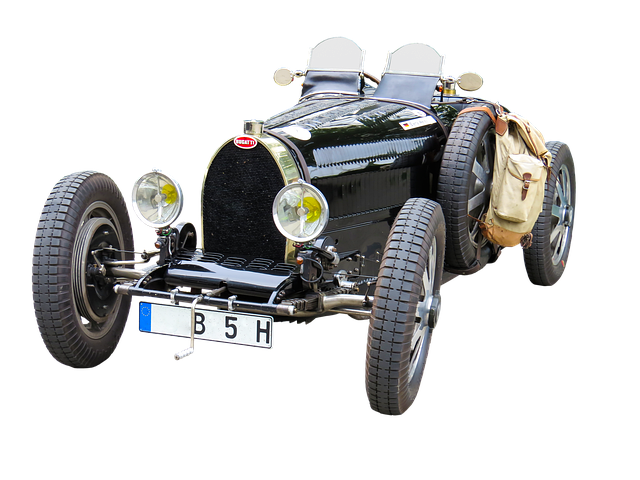

In Texas, title loan debt consolidation refers to combining multiple high-interest loans—typically car title loans—into a single, more manageable repayment structure. This is especially common among residents who have taken out several short-term, secured loans, often due to unexpected financial strains or limited access to traditional banking services. A secured loan, like a car title loan, uses an asset (in this case, the title to your vehicle) as collateral for the borrowed amount.

Understanding the terms and conditions of these loan terms is crucial before considering consolidation. Texas laws regulate these loans, but high-interest rates and stringent repayment requirements can still make them a financial burden. Debt consolidation offers a potential solution by providing lower interest rates and more flexible payment plans, allowing borrowers to catch their breath and regain control of their finances.

Benefits of Consolidation for Texas Borrowers

Texas borrowers facing multiple title loan debts can find relief through consolidation, offering several significant advantages. This process allows borrowers to combine their existing loans into a single, more manageable repayment structure. One of the primary benefits is simplified financial management, as borrowers no longer need to track and make separate payments for each individual title loan. Consolidation can lead to substantial savings in interest costs over time, especially if the new loan term is extended, providing borrowers with a chance to stay on top of their finances without being weighed down by numerous high-interest obligations.

Additionally, Texas title loan debt consolidation can provide borrowers with enhanced repayment options and flexibility. Through this process, they may be able to secure lower interest rates or negotiate more favorable terms, making it easier to repay the loan without the added strain of multiple due dates. A seamless loan payoff through consolidation also streamlines the repayment options, enabling borrowers to focus on rebuilding their financial stability with a clear and less daunting path forward.

Exploring Fees Associated with Consolidation

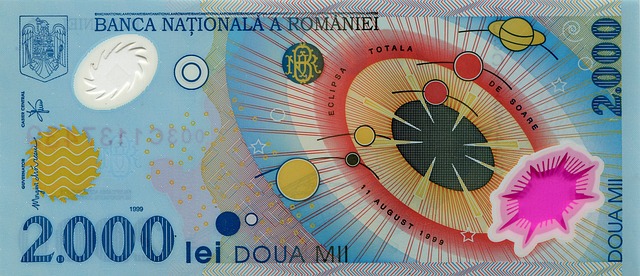

When considering Texas title loan debt consolidation, it’s crucial to explore all associated fees. These can include various charges related to the process, such as application fees, processing fees, and even vehicle inspection costs. Fort Worth Loans, known for their flexible payment plans, may also levy these expenses, which could impact the overall cost of consolidation.

Understanding these fees is essential for making an informed decision. While some lenders might offer attractive interest rates, hidden or additional charges can quickly add up. It’s recommended to thoroughly review the terms and conditions before agreeing to any consolidation plan, ensuring you have a clear picture of the financial commitment involved in Texas title loan debt consolidation.

Texas residents facing mounting debts from title loans can find relief through consolidation. This strategy offers a potential path to financial stability by simplifying payments and potentially reducing overall costs. However, it’s crucial to understand the associated fees with this process. When considering Texas title loan debt consolidation, borrowers should carefully review all terms and fees to make an informed decision that aligns with their financial goals and ensures they receive the most beneficial arrangement available in the Texas market.